What Is A Good Credit Score?

I am unable to get approval for my mortgage. The bank says my credit score is not good enough. What do I do? I often hear this from the people I work with.

A Credit Score is a very important part of our finances, these days, you realise that without a good credit score, even getting a property to rent, let alone, buy, can be very challenging if you have a poor credit score.

Credit rating is no more just about getting a mortgage, a personal loan or a credit card these days, even getting a mobile phone, opening a basic bank account and getting car insurance these days requires a good credit score. What does that mean to you, it means that it has become very imperative for everybody to do everything in their power to boost their credit score.

So, What Is A Credit Score?

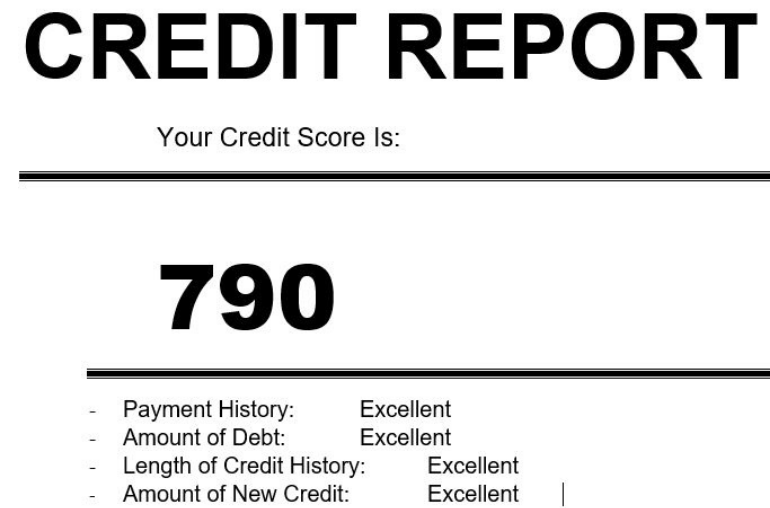

In simple terms, A Credit Score is simply a 3 – digit number that tells a lender how risky it is for them to give you credit. It is how a lender will assess your ability to pay them back. Your credit score tells the lender how good you are at managing your money.

Many people don’t realise that credit scoring is all about Debt. Your credit score simply gives information of your existing debt and how you’ve managed repaying the money you have borrowed in the past. Therefore, when you apply for credit of any sort, the lender will want to try and predict your behaviour for the future according to how you have behaved in the past

A great credit score simply puts you in a position where life could be smoother for you when going through everyday needs as you get the best deals for most dealings with the banks and other credit facilities, everyday things like your car insurance, car loan/lease etc. Lenders and other people use your credit score to determine how they will treat you when it comes to money matters.

Understanding your credit score and the benefits that come with having a great credit score can make life easier and ease a lot of money stress. But don’t let this scare you. The only problem is that most of us don’t know our credit score and what it means.

What Is A Good Credit Score?

In the UK, when we think of credit scoring, we think of Experian, Equifax and TransUnion.

These credit scoring agencies provide a credit score ranging from 0 to 600 for Equifax and 0 to 1000 for Experian.

Equifax:

|

Score |

Meaning |

|

0 to 278 |

Very poor |

|

279 to 366 |

Poor |

|

367 to 419 |

Fair |

| 420 to 466 |

Good |

| >467 | Excellent |

Experian |

|

| Score | Meaning |

|

0 to 560 |

Very Poor |

|

561 to 720 |

Poor |

|

721 to 880 |

Fair |

|

881 to 960 |

Good |

|

> 960 |

Excellent |

The above numbers may just look like numbers, but they represent very important information about you.

A high score is interpreted as, you could be trusted, and there is a high probability that you will pay back what you owe.

Most importantly, a high score gives you better access to credit and not just access, but also, you can get credit at a lower interest rate. A great credit score just makes life easier for you.

Though your credit score plays a big part in determining the decision that lenders make on giving you credit, there are some other factors that are also considered.

These include:

• Your Income

• Your employment history

• Your business history

It is important to monitor your credit score and constantly strive to improve on it

Managing your money appropriately, tracking your expenses, paying down debt and building your savings is the first step towards building an excellent credit.

If you haven’t already done so, grab our financial success pack and start taking control of your financial future today.