How to Improve Your Credit Score?

If you have been rejected for credit or you have checked your credit score and it is not good, do despair, there is always hope! There are so many different ways you can improve your credit score, and I’m going to show you some of the things that would work for you. Checklist are always a great place to start when a task is at hand.

Let us get started!

10 Tips on How to Improve Your Credit Score/Rating

1) Make Sure You Are on The Electoral Register

Yes, you read that right. If you are not on the electoral register, it would be hard for you to be accepted for credit. You can apply on the Gov.uk website.

I leant that some credit referencing agencies sell credit scores. Never try to buy a credit score. It won’t help you. Build your credit score legitimately and you will not regret it, in fact, you will thank yourself you did.

If you are not eligible to vote in the UK (non-common wealth or Non-EU citizen), then when you check your credit with the reliable credit agencies, provide them with your proof of residency (A UK Driving Licence and A Utility Bill). The credit agency should add a note to verify this.

2) Ensure that Any Financial Connections maintain Good Credit especially your spouse

Many people are not aware that if they are financially connected with someone, their credit will be affected by the persons financial actions.

What does it mean to be financially connected?

That means, you are connected with somebody on a financial product – the most common being a joined bank account. So be careful, flatmates, partners, because their file will become available when checking your credit and that will affect your credit score.

A joint mortgage, a joint bank account, a joint loan and a joint utility bill. For utility bills, normal flatmates with a joint utility bill may not be financially connected but a couple will be.

If you split up with somebody you were financially connected to, ensure you also split off the financial connection.

Keep your credit card balances on the down low. Literally.

If you have a lot of outstanding debt, that can negatively affect your credit score. Besides, it’s pretty stressful anyway!

One way to keep your credit card balances low is to pay off your debt in a timely manner. Don’t rack up credit card debt. Make sure when you spend money with a credit card, you can actually pay it off at the end of your billing cycle.

3) Keep Your Credit Card Balances Low and Low Personal Loan Amounts

If you already have a lot of debt outstanding on your credit cards or you have high personal loans, then that will affect your credit score negatively.

Debt is stressful. It is better to keep it as low as possible. It gets even frustrating if the debt is a bad debt (one which was incurred for purposes not honourable). Don’t spend money on your credit card to buy shoes and clothes if you don’t have the cash to pay it off. Make your credit card payments in time.

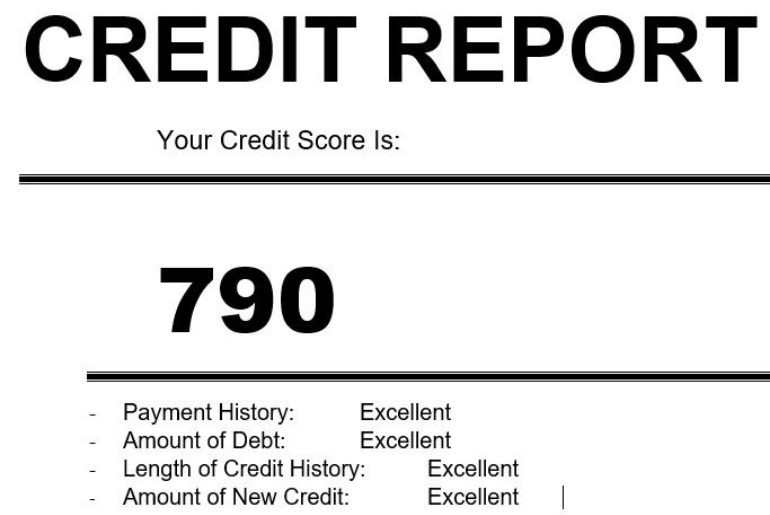

4) Request and Check Your Credit Report to Ensure There Are No Errors

Errors on your credit report may be responsible for lowering your credit score. These errors on your credit report can be disputed with the credit agency. We discussed how to obtain your credit report early on. Check one of the credit agencies we discussed (Experian, Equifax, TransUnion). You can request a credit report from them for free. Check it carefully and ensure all the information recorded in it is accurate. If you find any inaccurate information, raise a dispute with the agency for this to be corrected.

Debt can get very stressful and can affect you in ways you may not imagine.

If you have a high amount of debt, you need to start thinking of paying if off. This may be a good time to read our article on How to Get Out Of Debt

5) Credit Scores Change All the Time

Credit scores change all the time as our daily activities may affect our credit in one way or the other. In fact, this is the reason why you should stay on top of your credit report.

Why would credit scores change all the time, you may wonder?

This is because, as discussed earlier, your credit score is derived from a number of factors, including, the payments you made everyday to reduce your debt, the new credit applications you make as you go about your daily life.

Something as little as paying your weekly grocery bill for £250 on your credit card will increase your debt amount and therefore lower your credit score.

On the other hand, let’s say you bought a laptop on your credit card 18 months ago and have made all your minimum payments without fail to date, your credit score may go up.

Your credit score changes daily or even hourly. Therefore, if you want to make a major decision that will involve a hard credit check, request a credit report for yourself so that you know your credit score before you make the application. Many rejected credit applications will further reduce your credit score

6) Check Your Previous Addresses

You will be surprised how an address not changed on one of your financial dealings can affect your score. I learned this the hard way.

Many years back when I was still learning this credit matter, I moved house and didn’t take the time to change my addresses in all the financial connections I had. You know how many financial connections you can have when you have lived at the same address for many years. It could be really challenging just to remember to call each to change your address. Unfortunately, you have to. It would affect you credit in unbelievable ways. Again, your credit report will help you identify what addresses haven’t been changed. Request a credit report if you believe you should have good credit but have been rejected for credit, and if you move house, don’t apply for credit immediately. Wait a couple of months when you are all settled in the new address and have changed your address

7) Don’t Withdraw Cash on Your Credit

When you withdraw cash from your credit card, it can be seen as poor money management.

In addition to affecting your credit rating, withdrawing cash from your credit card is expensive. The interest rate is very high, above 27% for most credit cards and there is a cash charge as well. It is not a cheap option at all.

If you must withdraw cash from your credit card, do it the smart way. Get a money transfer offer from your credit card provider. These offers often come with a good credit score though.

8) Avoid Pay Day Loans

Pay day loans are generally targeted to those with poor credit because they cannot obtain credit from regular lenders. These loans, expose you and in addition, they are very expensive. It is better to use Credit Repair Credit Cards. If you use them well, they will improve your credit and generally cheaper than pay day loans.

9) Avoid Credit Repair Agencies

You probably see these advertised everywhere. RUN. They could mess you up even further, by using illegal methods that will worsen your situation.

If you desperately need help, there is the citizens advise bureau website which could give you more information about non-for-profit debt counselling agencies.

10) Use Your Savings If You Have Any

If you have debt, use any savings you have to reduce or pay off the debt. Why? We all talk about building a financial freedom fund (emergency fund), yes, we do. But think about it. Your savings pay you an interest of almost 0% today with the current economic situation, while your loan or credit card charges you 19.9% interest per annum. If you paid off your loan or credit card, then all the interest payments together with the normal payments, could be used to rebuild your savings account

If you have not already done so, grab out financial success pack below and take absolute control of your finances today.