Accounting 101 – Understanding Your Personal Financial Statements

When we talk about accounting, many people think business, but accounting is really something that applies to us as individuals in our daily lives just as much as it applies to business. As it has to do with numbers, many people tend to shy away from it, but it is the very basis for our finances.

Understanding the numbers makes a huge difference between the one who manages their money effectively and the one who doesn’t. It adds a great skill to your skill set when you understand the basics of accounting and how it can help you make informed decisions for your everyday finances.

It is never about how much money you earn; it is all about managing what you earn effectively. You can only be successful in that if you understand the numbers. They are really basic and every child should be made to learn these skills before they start earning money.

What is Accounting?

In simple terms, accounting is defined as the process of recording, analysing and interpreting your financial information.

If you look at your household as a business entity, then you would be able to see straight away how accounting applies to your household, especially, you will be able to come up with the basic accounting documents required to help the entity (YOU) run their business smoothly (Everyday Life).

These documents include:

• The House hold Income Statement

• The household Balance Sheet

• The household Cashflow Statement

The household Income statement (shows how much your household income and expenses are over a period of time, often a month for most families) and the household Balance Sheet (shows how much assets and liabilities you have at a particular date – Your Net Worth).

Managing your money effectively begins with understanding your financial statements. You have to learn how to read and create these personal financial statements so that you can budget your finances properly. This is simple. It is all about understanding what is categorised as your income, your expenses, your assets and your liabilities.

Now that you understand the basics of what Financial Statements are, how do you create your own financial statements to enable you manage your money effectively and make sound financial decisions?

Creating Your Personal Financial Statements

1) The Personal Income Statement

To prepare your personal income statement, you need two pieces of information:

• Your Income (money that flows into your pocket from all sources) and

• Your expenses (money that leaves your pocket)

Your Net Monthly Cash Flow will be Total Income Less Total Expenses

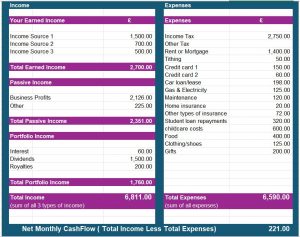

Here is an example:

Let’s talk about each of the elements of the Income Statement

Earned Income

This is money that you earn from working, that is, salary, commissions etc

Passive Income

This is income earned from a business that does not require the individual to work directly for it or for the individual to be actively involved in earning.

Examples include:

– Income from Property Rentals

– Income from a business where the individual is an inactive/limited partner

With the internet and social media boom, new businesses of the 21st century have been established such that people can earn residual income, which is a form of passive income.

Most work-from-home and be-your-own boss businesses give their owners the opportunity to earn passive income.

Passive income can also come from interest earned from savings, royalties, dividends from share ownership

Portfolio Income

This is profits from the sale of investments, which may include, shares, a business and property.

The Expenses Section of The Personal Finance Income Statement

What is an expense in personal finance?

It is everything that you pay out each month from your earnings.

These include:

– Your Mortgage payments (or your rental payments)

– Your student loan payments

– Your household food payments

– Your Gas and Electricity Payments

– Your Insurances

– Your clothes, shoes

– Your taxes

– Your monthly subscriptions

The reason why it is very important to prepare your own personal financial statements, is because, it enables you to see how much you earn and how much you spend every month.

This will help you live within your means and if your means are not good enough, it will enable you think of ways of expanding your means.

The wise money spending secrets for success reveal that, a household that manages it’s finances effectively, spends 70% of their income on their bills, that is, they will live on and spend only 70% of their earnings, they will save 10% of their earnings, invest 10% and give 10% to charity.

If you are in debt, you spend 70% of your income, save 10% and use 20% for the payment of your debt until you finish paying off your debt.

Change your words, change your live. If you change your words from I cannot afford it, to how can I afford it, it leads us to start thinking of ways we can expand our thinking and increase our earnings.

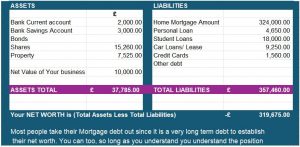

2) The Personal Balance Sheet

Just like for any business, the household balance sheet is a very important element of running your household finances. It is what tells you what your net worth is. It tells you what you own and what you owe others.

The balance sheet consists of two main elements:

Assets and Liabilities

See Example illustration below:

What are assets and what are liabilities?

People always get confused about what is really an asset and what a liability is.

Assets:

In personal finance, an Asset is defined as anything that puts money in your pocket, irrespective of what it is.

That means, your car and even your home may not be assets, unless they put money in your pocket. So if you use your car to earn money, e.g. as a taxi for instance, then it is an asset, otherwise, it is not an asset. Your home is not an asset unless you receive rents from it or it have equity in it.

Liabilities

A liability in personal finance, is something that takes money out of your pocket. Your car used just for commuting is a liability to your household and yourself because every month, it takes money out of your pocket, you pay for fuel, car insurance, repairs and your car loan/lease, etc.

Take some time to prepare your own set of Financial Statements (Income Statement & Balance Sheet)

Use the illustrated examples above as your guide.

Why It is Important to prepare your own personal financial statements on a regular basis

Society defines assets and liabilities differently, such that there are a lot of things considered as assets, which are liabilities, in actual fact, like your car for example. When you buy a new car, as soon as it’s driven out of the dealership, it depreciates significantly. The value of the car goes down but your monthly payments continue as though the car is still in a new state, but If you were to sell the car, then you understand the significant difference in value.

Understanding your personal financial statements helps you understand what your assets are and what your liabilities are when managing your money.

Your personal financial statements will help you identify your own financial position so that you can set appropriate financial goals for yourself and take action towards achieving your own financial freedom if that is something you are interested in.

There is a lot of noise about financial freedom and people belief they must be running a business or chasing some money making opportunity always.

Achieving financial stability first and foremost should be every woman’s goal. Learn to build your wealth out of what ever you earn. Learning how to manage small amounts will enable you manage larger amounts when the time comes. Taking the stress out of money is all about understanding your spending your habits, tracking your spending, ensuring that you pay down debt and free up your cash flow so that you can use for the things that really matter.

If you have not already done so, grab out financial success pack and start transforming your financial future today.